Working Abroad Part 4: Limited Company or Umbrella Company?

UPDATE: Changes to the IR35 Intermediaries legislation, coming into effect for ** **the 2017/2018 tax year, mean that working as an OT locum through a limited ** **company is no longer an attractive option for me.

In the six weeks before I left Australia to start working in the UK, the agencies started asking "Are you going with an umbrella company or a limited company?" I was completely puzzled at why I needed either of them. How do they work? What's the difference? And no one would give any guidance due to legal reasons.

1. Why do you NEED to choose one or the other?

When working as a locum in the UK, you are a contractor. That is, you need to be self-employed. The organisation you work for (e.g. the NHS or Social Services) doesn't employ you, and the recruitment agency doesn't employ you. The organisation contracts the agency to provide them with workers, and the agency contracts you, the worker, to provide the service for the organisation.

So, you need a legal entity to act as your 'employer'. You can do it yourself, through a Limited Company. Or you can have someone else do it for you: an Umbrella Company.

2. What is the difference?

The difference is in how you get paid, and your legal rights and obligations.

Umbrella Company: You are an employee of the umbrella company. You submit your timesheet and claimable expenses to the umbrella company. Your gross pay goes from the agency to the umbrella company. They take out taxes and their fees. They deposit your net pay into your bank account. I chose to set up my own limited company, so I don't have any first-hand experience of umbrella companies. As you are an employee, many umbrella company provide sick pay and other statutory benefits. Some also include insurance cover and pension schemes.

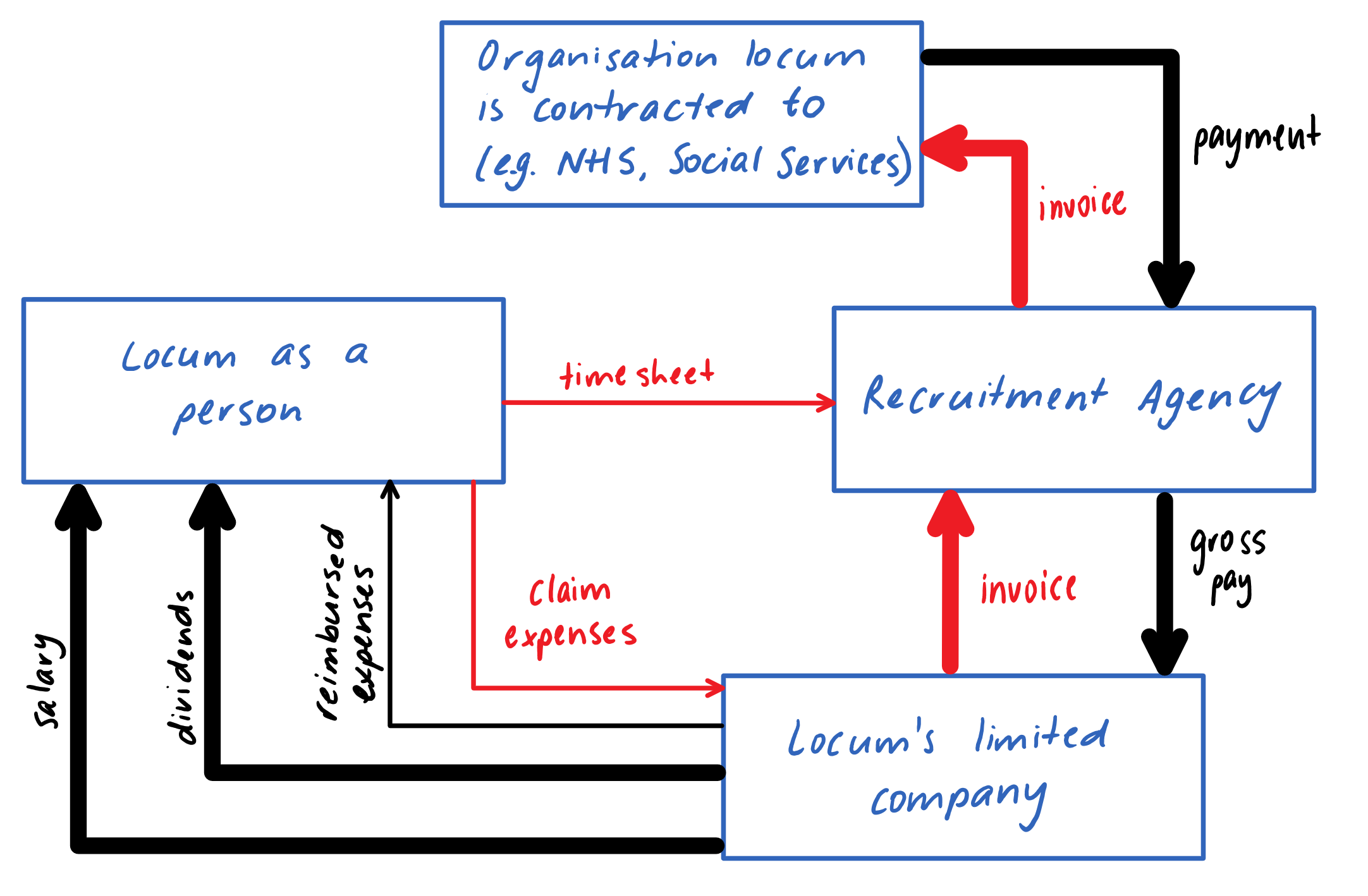

Limited Company: You are the sole employee, director and 100% shareholder of a limited company. See the diagram below. The recruitment agency pays your company, and your company pays you (you pay yourself) salary, dividends, and reimbursable expenses. Your company pays Corporation Tax. You are your own employer. You are 100% legally responsible for yourself.

Red = requests for payment, Black = payments

Yes, I know. It looks very confusing. It took me a little while to get my head around how to process all the paperwork! I'm really glad to be with Income Made Smart (IMS). They helped me set up my company, and provide mentoring whenever I need it. They've been very helpful. If you decide to use their service, please say I (Amy Hilaire) referred you. That would really help to fund this blog!

Legally, a limited company gives you more responsibility. I am the sole director of my limited company. Therefore, it's my responsibility to ensure my company is compliant with all legislation regarding employment and taxes etc. It seems complicated, but IMS help a lot.

3. How to choose?

In the end, it's really down to personal preference, and risk versus return.

A good umbrella company:

- reduces your risk, because their trained professionals take care of all your tax etc and all you have to worry about is how to spend your take-home pay.

- reduces your return (income). From what I've heard, umbrella companies charge a lot for their service, and your take-home pay is less than if you have a limited company.

- reduces your admin time a little. You still have to submit your timesheet and your expenses.

A limited company:

- increases your return. You're not paying anyone else to do admin for you. Your tax is generally less.

- I pay weekly fees to IMS to help me manage my company, but I believe this is much less.

- increases your risk, as you get no sick pay or included insurance, so it's up to you to keep savings aside for this. And you may have a personal tax bill at the end of the tax year, depending on your situation.

- increases your options. For example, my company bought a laptop for me to use, pre-tax.

4. Words of Warning

Do your own research. It's very easy just to go with recommendations from your agency to find help with setting up a limited company, or an umbrella companies to sign up with. Keep in mind that the agencies get referral bonuses and may refer you to the companies that pay the most for referrals rather than the one that is in your best interest.

Please share your questions or experiences below. All questions will be answered.